This is gonna be pretty boring to most people.

Everybody has bad days at work. My days seem to be worse than everybody else's.

I had problems with trip 197, Salem VA to Houston, from the beginning.

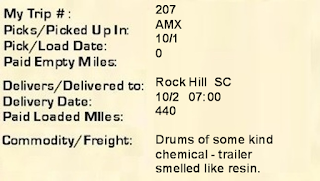

From the QualComm on 09/02/09:ME: 14:47This freight is 55 gal drums of stuff on pallets held together with only shrinkwrap. They put a "rope" of shrinkwrap at the top of the drums, and the guy said that was stronget than anything else they could use.

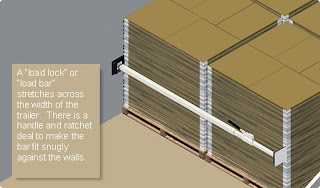

Said that to say this: The woman who brought my bills out said I needed to put a strap or load bar on the stuff. She wasn't around by the time I got on the dock with my load lock, but that guy was. I said, "Why does this need a load lock?" He said, "You don't have a strap?" I said no. He tried to help me put the bar up, but the sides of the trailer are so bowed out it wouldn't stretch across, and we couldn't make it reach a rib.

I said, "Well, if anything happens, I've done my part." and I told him, "just between you and me, y'all ought to use something better than shrinkwrap to hold these things together."

Will try CHR again in a minute.

A few notes here: CHR = C.H. Robinson, the broker. When CHR dispatched me, they only asked if I had load locks. I've talked about CHR before - look over in the sidebar; find the tag "C.H. Robinson"; and click on it if you want to see what I've said in previous posts.

Putting a load lock in the trailer wasn't a problem, but when I saw the load was low and solid, I wondered why they wanted me to secure it. Most of the shippers I deal with don't ask for securement, and we don't haul much freight where it's needed. But there've been times when I secured a load anyway - just to be sure. Take the load of 12 packs of Dr. Pepper the other day, for instance. Using a load lock was my choice, and I decided to put one up - just to be sure.

Anyway, at the time, I didn't think about this being a liquid load. It meant that the stuff would slosh around in the drums, and maybe cause the last pallet to "walk" around some - if the shrink wrap held. Still, the guy on the dock said, "If the drivers have straps, ok. If they don't, we don't use anything."

AMX provides us with load locks - we carry them in a rack on the back of our tractors. AMX doesn't provide straps.

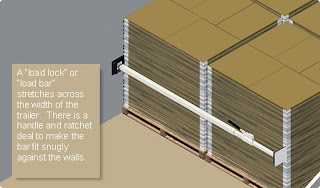

This is how a load lock works:

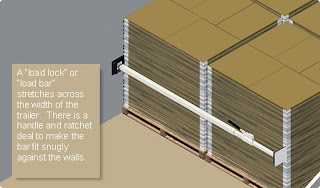

And this is how a strap works:

ME: 14:52

ME: 14:52

...we left the load lock on the floor and he didn't seem to think it was a big deal that we couldn't secure them.

007: 15:14

You may need to go buy some straps to secure the load. Need to make sure you do that.Note: 007 never uses any kind of punctuation in her messages, so what I read looked like this (all incoming messages are in capital letters): YOU MAY NEED TO GO BUY SOME STRAPS TO SECURE THE LOAD NEED TO MAKE SURE YOU DO THAT

ME: 15:22

So are you telling me to buy some straps for this load? BTW - I may not be able to make it by 3:00pm Friday, but will do my best. Note: Trip 197 paid 1147 loaded miles, but actual miles are closer to 1175.

No dispatcher

ever figures trip time by actual miles.

No dispatcher

ever considers the fact that a heavy load in mountainous terrain will slow a driver down considerably.

No dispatcher

ever considers that a curving, twisting, or winding highway will slow a driver down considerably - not to mention that kind of driving is real work.

No dispatcher

ever considers the possibility that we may have to wait in line for fuel for 45 minutes.

No dispatcher

ever considers the fatigue factor - that a driver may need a little extra time simply because he/she is worn out.

No dispatcher

ever considers waiting to load or unload is not a "rest" period.

No dispatcher

ever considers that sweeping a trailer out, or other equipment issues, involves physical labor.

I could go on and on.

It's not just 007 either. All dispatchers are this way. It's their job. See this post -

14 Hour Violation In orientation at AMX, when I first hired on, Nolielauri said trips were figured at 55mph, and in the next breath said 50mph. I usually figure actual miles at 55, so Trip 197, 1175 miles at 55mph = 21.36 hours. 11 hours of driving requires a 10 hour break. So 21.36 divded by 11 = two 10 hour breaks. Now the trip's up to 43.5 hours.

And at 2:45pm, about the time I finally got loaded, I had 48 hours to get there - logging it legally. That left 4.5 extra hours for whatever might come up. It was doable on paper but it mean driving 10 hours straight from Salem - and I'd already been working since 8:00am.

When I called CHR to tell them I was loaded, I mentioned the load lock problem, and the girl blew it off. I also told her I might not be able to make it by 3:00pm. After some checking and being put on hold a couple of times, the girl came back and told me it had to deliver by 3:00 - Monday would be too late. I didn't realize Monday was a holiday yet.

ME: 15:34

... come on somebody - b4 I get to fuel stop - u want me to buy straps for this load?

007: 15:36

IF IT WILL SECURE THE PRODUCT YES YOU NEED TO ALSO THIS LOAD MUST NO EXCEPTION DELIVER ON FRIDAY THEERE IS NO REASON IN THIS WORLD THAT YOU CANT MAKE THAT IT BY 1500 ON FRIDAY YOU HAVE 46 HRS TO DO IT IN I DONT THINK THAT IS AKING TO MUCH

ME: 15:40 Y'all will reimburse me for straps, right? As for making it by 3 Friday, I won't argue about it.Note: 007 hadn't specifically told me to buy straps for the load yet, and I wanted to be sure I'd get reimbursed. Straps are not cheap. As for not arguing about the delivery time, I already knew I was going to do whatever it took to make it. By this time I knew Monday was Memorial Day, the reason for the "007 push".

007: 15:43 I SAID YES BUY THEM IF IT WILL HELP SUCURE THE LOAD I SENT YOU A MESSAGE

ME: 15:45 Ok

007: 15:46 YES PUT PER CAROL ON THE RECEIPT AND PER DAN AND KEITH LOAD MUST BE THERE ON TIME FRIDAY

ME: 15:51 That's all I needed to hear. If Dan and Keith say to get it there regardless, it'll be there. Sometimes I think y'all put your index finger and thumb in the air and say "It's only this far on the map."Note: 007 didn't respond, so to me this meant Whatagreatguy and Keith knew the circumstances, and I wouldn't get called down for throwing the log book out the window. I had to get some rest, but I'd do it in snatches instead of 10 hours at a time. That way I'd be able to make it on time.ME: 17:19 ...and y'all never figure things like 45 mins just to get to a fuel pump.... (Sent while I was sitting in line at the pumps. This was where the fuel route on the QualComm told me to stop.)

From the QualComm on 09/04/09:ME: 8:55 PLEASE DON'T STOP TILL YOU GET TO CUSTOMER NEED TO RELOAD BY 15:00

ME: 9:00 Sometime today I've got to take a full 10 hour break to get legal again, but I don't intend to stop again until I get there.

ME: 9:02 YOU CAN TAKE A BREAK AFTER U RELOAD YOU ARE RELOADING IN HOUSTIN 800 MILES FROM NOW TO TUESDAY I THINK YOU CAN GET PLENTY OF BREAKS IN

ME: 9:03 Good deal.

ME: 9:04 I'll drive 24/7 as long as Keith and Dan approve it.

ME: 9:07 ...2 hour nap here, 5 hours there - I'd rather do it that way anyway.

007: 11:26 ARE U ALMOST AT CUSTOMER

ME: 11:27 Yes

ME: 12:14 unloading now I sent in my empty call and she sent the next load info to me. It picked up at BASF on the west side of Houston. I drove over there.

ME: 13:51 Guy at BASF says this load has already been picked up

007: 14:00 WE ARE CALLING NOW

007: 14:23 TAKING YOU OFF LOAD UPDATE YOU ASP

ME: 14:24 I'm going back to the east side of town then - to the truck stops.

ME: 15:15 Do you think y'all will be able to get me out of here today?I was hoping they wouldn't. I was totally exhausted, and I didn't like the shape my log book was in compared to the GPS.

007: 15:38 NOT SURE

ME: 15:39 Ok, thx.

ME: 16:12 Just leave he here. Unless it's across the street, I can't get anywhere by closing time anyway.Please just leave me here.

007: 16:44 WE HAVE A LOAD IN HOUSTON TODAY AS SOON AS I GET THE FAX ILL SEN TO YOU SO BE READY THANKS

ME: 16:51 It'll take forever to get there the way traffic is now, but good deal.

I didn't really think it was a good deal.

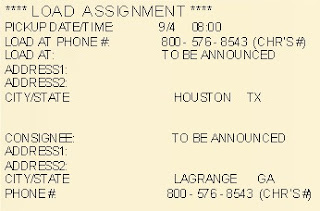

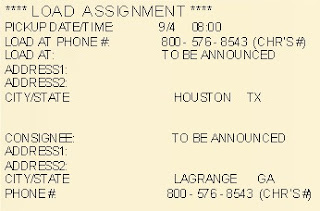

And then came the Load Assignment at 17:02:

007: 17:02 CALL BROKER ASAP # IN COMMENTS

007: 17:02 CALL BROKER ASAP # IN COMMENTS...and she was gone. It was after 5:00pm and her day was done. She could walk away and leave it all behind.

When I saw the load assignment my heart sank. No information whatsoever, and the numbers listed were both for C.H. Robinson. And 007 had walked away leaving me holding the bag. I was sick.

I called CHR and the guy told me it was one pallet (seriously, one pallet) of phones. I said, "Aw man, this isn't going to pan out." He said, "It might not, it might not." He told me to sit tight and he'd call me back in 10 minutes - because he didn't want me to go after the one pallet of phone if it wasn't a sure-fire thing. By this time he knew I had log problems, and he knew I was seriously concerned about it.

Me: 17:07 Y'all better not count these chickens yet - this sounds like another fall through...but nobody was listening. I kept trying though:

Me: 17:28 ... this is not a good deal at all.

Let me stay where I am. It's not worth the risk if anything should happen.CHR didn't call me 10 minutes later, so I called him. I told him about how I'd never drive again if anything happened in the traffic - not to mention AMX would be sued for everything they had. I told him I couldn't get anybody to answer at AMX. I was almost in tears. I told him I was between a rock and hard place, but I'd go pick it up if it was legitimate.

He told me the shipper hadn't called him back so he thought it wasn't going to work out anyway. I told him, "Let's pray it doesn't". He said he'd call me right back - that he was going to tell the shipper he needed a "yes" or "no". He called back so quickly that I got the impression the shipper didn't answer. After all, it was almost 5:45pm by now - on a 3 day weekend. When he did, he said, "Your praying paid off, so just get some rest, and we'll talk to you Tuesday I guess."

Me: 17:43 CHR just called me back. The deal fell through."

Me: 17:55 I've been trying to call, but I guess everybody's gone home now. I'm not going to worry about it anymore. Maybe something'll turn up tomorrow. Things will be better then anyway.

I didn't know who sent the message at 18:46: CAN YOU CALL ME PLEASE?

ME: 18:52: I've been trying to call. Nobody answers - not even the guard

GUARD: 18:56: THIS IS THE GUARD. I HAVE NOT HAD A CALL FROM YOU.So I called and talked to a young man I didn't know. CHR had called him, and he wanted to know what was going on. I told him.

From the QualComm on 09/05/09:ME: 10:00: Dispatch, did you see that my load fell through yesterday?

007: 10:02: SURE DID AND BROKER ALSO INFORMED US THAT YOU WERE GLAD IT DID SO YOU CAN SIT THERE TILL TUESDAY

ME: 10:23: I don't care if I sit here 'till doom's day. At least everything's legal again, and nobody got hurt.

The broker knew I was worried about my log problem, but I told him I'd go get it if it was a legitimate load. He told me to sit tight while he called the shipper

He was going to tell the shipper to give him a yes or no

He called back almost immediately and said it wasn't a load. I got the impression nobody answered at the shipper.

I was glad because nobody was at risk anymore if anything had happened in the heavy holiday traffic. In fact, I was real glad - for myself and AMX.

The more I thought about it, the more worried I got that something might happen. I was between a rock and a hard place. So yeah, I'm glad it fell through. So here I sit at the Flying J in Houston - across the street from the TA. Thank goodness it's not like last Christmas was when a "007 push" didn't work out. Everybody knows about that by now though, when Buddy and I spent 4 or 5 days at a Flying J in PA - and I missed a doctor's appointment because of it.

This is gonna be pretty boring to most people.

Everybody has bad days at work. My days seem to be worse than everybody else's.

I had problems with trip 197, Salem VA to Houston, from the beginning.

From the QualComm on 09/02/09:ME: 14:47This freight is 55 gal drums of stuff on pallets held together with only shrinkwrap. They put a "rope" of shrinkwrap at the top of the drums, and the guy said that was stronget than anything else they could use.

Said that to say this: The woman who brought my bills out said I needed to put a strap or load bar on the stuff. She wasn't around by the time I got on the dock with my load lock, but that guy was. I said, "Why does this need a load lock?" He said, "You don't have a strap?" I said no. He tried to help me put the bar up, but the sides of the trailer are so bowed out it wouldn't stretch across, and we couldn't make it reach a rib.

I said, "Well, if anything happens, I've done my part." and I told him, "just between you and me, y'all ought to use something better than shrinkwrap to hold these things together."

Will try CHR again in a minute.

A few notes here: CHR = C.H. Robinson, the broker. When CHR dispatched me, they only asked if I had load locks. I've talked about CHR before - look over in the sidebar; find the tag "C.H. Robinson"; and click on it if you want to see what I've said in previous posts.

Putting a load lock in the trailer wasn't a problem, but when I saw the load was low and solid, I wondered why they wanted me to secure it. Most of the shippers I deal with don't ask for securement, and we don't haul much freight where it's needed. But there've been times when I secured a load anyway - just to be sure. Take the load of 12 packs of Dr. Pepper the other day, for instance. Using a load lock was my choice, and I decided to put one up - just to be sure.

Anyway, at the time, I didn't think about this being a liquid load. It meant that the stuff would slosh around in the drums, and maybe cause the last pallet to "walk" around some - if the shrink wrap held. Still, the guy on the dock said, "If the drivers have straps, ok. If they don't, we don't use anything."

AMX provides us with load locks - we carry them in a rack on the back of our tractors. AMX doesn't provide straps.

This is how a load lock works:

And this is how a strap works:

ME: 14:52

ME: 14:52

...we left the load lock on the floor and he didn't seem to think it was a big deal that we couldn't secure them.

007: 15:14

You may need to go buy some straps to secure the load. Need to make sure you do that.Note: 007 never uses any kind of punctuation in her messages, so what I read looked like this (all incoming messages are in capital letters): YOU MAY NEED TO GO BUY SOME STRAPS TO SECURE THE LOAD NEED TO MAKE SURE YOU DO THAT

ME: 15:22

So are you telling me to buy some straps for this load? BTW - I may not be able to make it by 3:00pm Friday, but will do my best. Note: Trip 197 paid 1147 loaded miles, but actual miles are closer to 1175.

No dispatcher

ever figures trip time by actual miles.

No dispatcher

ever considers the fact that a heavy load in mountainous terrain will slow a driver down considerably.

No dispatcher

ever considers that a curving, twisting, or winding highway will slow a driver down considerably - not to mention that kind of driving is real work.

No dispatcher

ever considers the possibility that we may have to wait in line for fuel for 45 minutes.

No dispatcher

ever considers the fatigue factor - that a driver may need a little extra time simply because he/she is worn out.

No dispatcher

ever considers waiting to load or unload is not a "rest" period.

No dispatcher

ever considers that sweeping a trailer out, or other equipment issues, involves physical labor.

I could go on and on.

It's not just 007 either. All dispatchers are this way. It's their job. See this post -

14 Hour Violation In orientation at AMX, when I first hired on, Nolielauri said trips were figured at 55mph, and in the next breath said 50mph. I usually figure actual miles at 55, so Trip 197, 1175 miles at 55mph = 21.36 hours. 11 hours of driving requires a 10 hour break. So 21.36 divded by 11 = two 10 hour breaks. Now the trip's up to 43.5 hours.

And at 2:45pm, about the time I finally got loaded, I had 48 hours to get there - logging it legally. That left 4.5 extra hours for whatever might come up. It was doable on paper but it mean driving 10 hours straight from Salem - and I'd already been working since 8:00am.

When I called CHR to tell them I was loaded, I mentioned the load lock problem, and the girl blew it off. I also told her I might not be able to make it by 3:00pm. After some checking and being put on hold a couple of times, the girl came back and told me it had to deliver by 3:00 - Monday would be too late. I didn't realize Monday was a holiday yet.

ME: 15:34

... come on somebody - b4 I get to fuel stop - u want me to buy straps for this load?

007: 15:36

IF IT WILL SECURE THE PRODUCT YES YOU NEED TO ALSO THIS LOAD MUST NO EXCEPTION DELIVER ON FRIDAY THEERE IS NO REASON IN THIS WORLD THAT YOU CANT MAKE THAT IT BY 1500 ON FRIDAY YOU HAVE 46 HRS TO DO IT IN I DONT THINK THAT IS AKING TO MUCH

ME: 15:40 Y'all will reimburse me for straps, right? As for making it by 3 Friday, I won't argue about it.Note: 007 hadn't specifically told me to buy straps for the load yet, and I wanted to be sure I'd get reimbursed. Straps are not cheap. As for not arguing about the delivery time, I already knew I was going to do whatever it took to make it. By this time I knew Monday was Memorial Day, the reason for the "007 push".

007: 15:43 I SAID YES BUY THEM IF IT WILL HELP SUCURE THE LOAD I SENT YOU A MESSAGE

ME: 15:45 Ok

007: 15:46 YES PUT PER 007 ON THE RECEIPT AND PER WHATAGREATGUY AND KUNG FU LOAD MUST BE THERE ON TIME FRIDAY

ME: 15:51 That's all I needed to hear. If Whatagreatguy and Kung Fu say to get it there regardless, it'll be there. Sometimes I think y'all put your index finger and thumb in the air and say "It's only this far on the map."Note: 007 didn't respond, so to me this meant Whatagreatguy and Kung Fu knew the circumstances, and I wouldn't get called down for throwing the log book out the window. I had to get some rest, but I'd do it in snatches instead of 10 hours at a time. That way I'd be able to make it on time.ME: 17:19 ...and y'all never figure things like 45 mins just to get to a fuel pump.... (Sent while I was sitting in line at the pumps. This was where the fuel route on the QualComm told me to stop.)

From the QualComm on 09/04/09:ME: 8:55 PLEASE DON'T STOP TILL YOU GET TO CUSTOMER NEED TO RELOAD BY 15:00

ME: 9:00 Sometime today I've got to take a full 10 hour break to get legal again, but I don't intend to stop again until I get there.

ME: 9:02 YOU CAN TAKE A BREAK AFTER U RELOAD YOU ARE RELOADING IN HOUSTIN 800 MILES FROM NOW TO TUESDAY I THINK YOU CAN GET PLENTY OF BREAKS IN

ME: 9:03 Good deal.

ME: 9:04 I'll drive 24/7 as long as Kung Fu and Whatagreatguy approve it.

ME: 9:07 ...2 hour nap here, 5 hours there - I'd rather do it that way anyway.

007: 11:26 ARE U ALMOST AT CUSTOMER

ME: 11:27 Yes

ME: 12:14 unloading now I sent in my empty call and she sent the next load info to me. It picked up at BASF on the west side of Houston. I drove over there.

ME: 13:51 Guy at BASF says this load has already been picked up

007: 14:00 WE ARE CALLING NOW

007: 14:23 TAKING YOU OFF LOAD UPDATE YOU ASP

ME: 14:24 I'm going back to the east side of town then - to the truck stops.

ME: 15:15 Do you think y'all will be able to get me out of here today?I was hoping they wouldn't. I was totally exhausted, and I didn't like the shape my log book was in compared to the GPS.

007: 15:38 NOT SURE

ME: 15:39 Ok, thx.

ME: 16:12 Just leave he here. Unless it's across the street, I can't get anywhere by closing time anyway.Please just leave me here.

007: 16:44 WE HAVE A LOAD IN HOUSTON TODAY AS SOON AS I GET THE FAX ILL SEN TO YOU SO BE READY THANKS

ME: 16:51 It'll take forever to get there the way traffic is now, but good deal.

I didn't really think it was a good deal.

And then came the Load Assignment at 17:02:

007: 17:02 CALL BROKER ASAP # IN COMMENTS

007: 17:02 CALL BROKER ASAP # IN COMMENTS...and she was gone. It was after 5:00pm and her day was done. She could walk away and leave it all behind.

When I saw the load assignment my heart sank. No information whatsoever, and the numbers listed were both for C.H. Robinson. And 007 had walked away leaving me holding the bag. I was sick.

I called CHR and the guy told me it was one pallet (seriously, one pallet) of phones. I said, "Aw man, this isn't going to pan out." He said, "It might not, it might not." He told me to sit tight and he'd call me back in 10 minutes - because he didn't want me to go after the one pallet of phone if it wasn't a sure-fire thing. By this time he knew I had log problems, and he knew I was seriously concerned about it.

Me: 17:07 Y'all better not count these chickens yet - this sounds like another fall through...but nobody was listening. I kept trying though:

Me: 17:28 ... this is not a good deal at all.

Let me stay where I am. It's not worth the risk if anything should happen.CHR didn't call me 10 minutes later, so I called him. I told him about how I'd never drive again if anything happened in the traffic - not to mention AMX would be sued for everything they had. I told him I couldn't get anybody to answer at AMX. I was almost in tears. I told him I was between a rock and hard place, but I'd go pick it up if it was legitimate.

He told me the shipper hadn't called him back so he thought it wasn't going to work out anyway. I told him, "Let's pray it doesn't". He said he'd call me right back - that he was going to tell the shipper he needed a "yes" or "no". He called back so quickly that I got the impression the shipper didn't answer. After all, it was almost 5:45pm by now - on a 3 day weekend. When he did, he said, "Your praying paid off, so just get some rest, and we'll talk to you Tuesday I guess."

Me: 17:43 CHR just called me back. The deal fell through."

Me: 17:55 I've been trying to call, but I guess everybody's gone home now. I'm not going to worry about it anymore. Maybe something'll turn up tomorrow. Things will be better then anyway.

I didn't know who sent the message at 18:46: CAN YOU CALL ME PLEASE?

ME: 18:52: I've been trying to call. Nobody answers - not even the guard

GUARD: 18:56: THIS IS THE GUARD. I HAVE NOT HAD A CALL FROM YOU.So I called and talked to a young man I didn't know. CHR had called him, and he wanted to know what was going on. I told him.

From the QualComm on 09/05/09:ME: 10:00: Dispatch, did you see that my load fell through yesterday?

007: 10:02: SURE DID AND BROKER ALSO INFORMED US THAT YOU WERE GLAD IT DID SO YOU CAN SIT THERE TILL TUESDAY

ME: 10:23: I don't care if I sit here 'till doom's day. At least everything's legal again, and nobody got hurt.

The broker knew I was worried about my log problem, but I told him I'd go get it if it was a legitimate load. He told me to sit tight while he called the shipper

He was going to tell the shipper to give him a yes or no

He called back almost immediately and said it wasn't a load. I got the impression nobody answered at the shipper.

I was glad because nobody was at risk anymore if anything had happened in the heavy holiday traffic. In fact, I was real glad - for myself and AMX.

The more I thought about it, the more worried I got that something might happen. I was between a rock and a hard place. So yeah, I'm glad it fell through. So here I sit at the Flying J in Houston - across the street from the TA. Thank goodness it's not like last Christmas was when a "007 push" didn't work out. Everybody knows about that by now though, when Buddy and I spent 4 or 5 days at a Flying J in PA - and I missed a doctor's appointment because of it.

2006 seried Dollar Bills - $16.00 costs $32.00 at the The United States Treasury Bureau of Engraving and Printing.

2006 seried Dollar Bills - $16.00 costs $32.00 at the The United States Treasury Bureau of Engraving and Printing.

So I Googled "Mandatory loans to unqualified borrowers". One of the first results caught my attention - U.S. Debt Default, Dollar Collapse Altogether Likely - an article written by somebody I've never heard of on a website I've never heard of. Nevertheless, it's interesting enough that I want to digest it further.

So I Googled "Mandatory loans to unqualified borrowers". One of the first results caught my attention - U.S. Debt Default, Dollar Collapse Altogether Likely - an article written by somebody I've never heard of on a website I've never heard of. Nevertheless, it's interesting enough that I want to digest it further.